Forex patterns flag

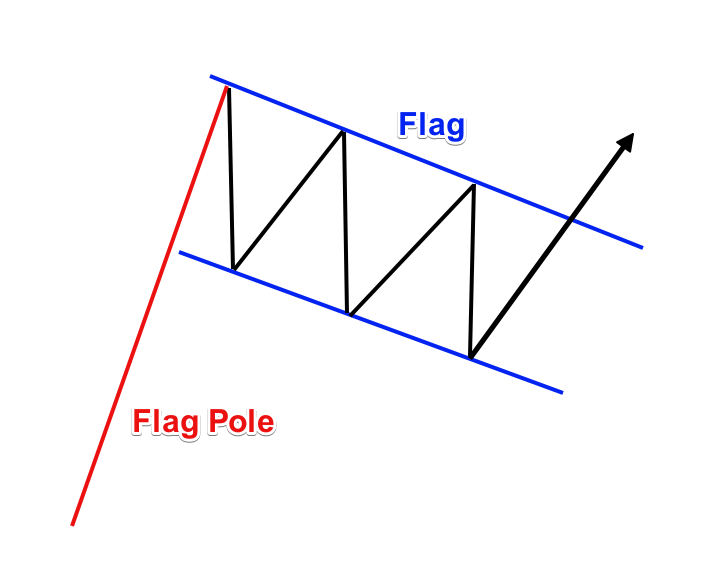

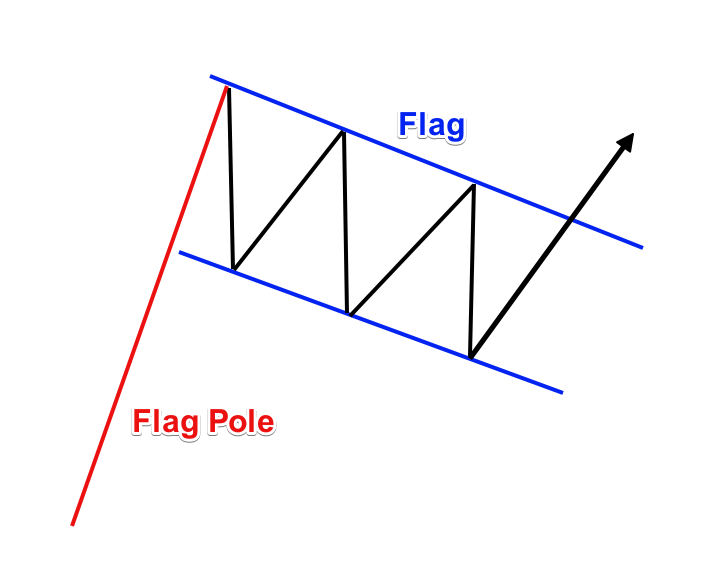

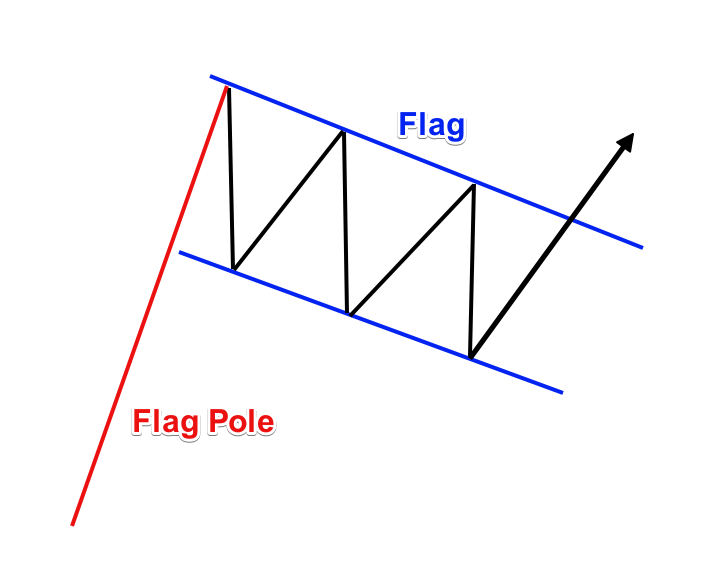

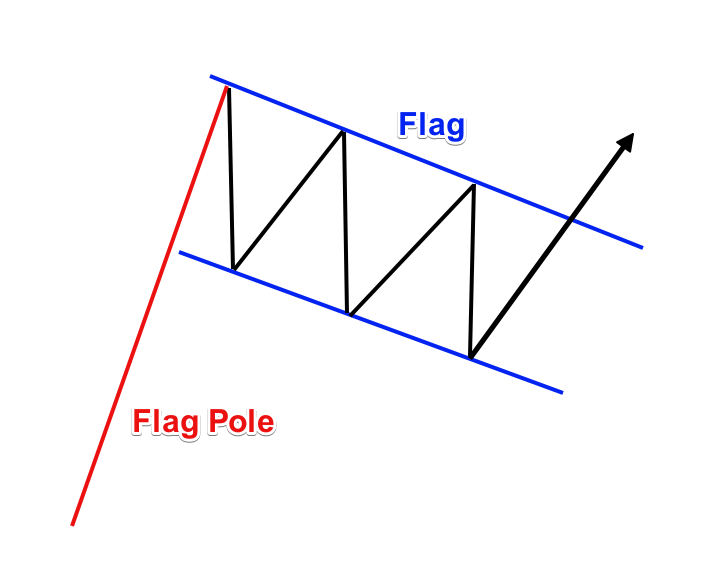

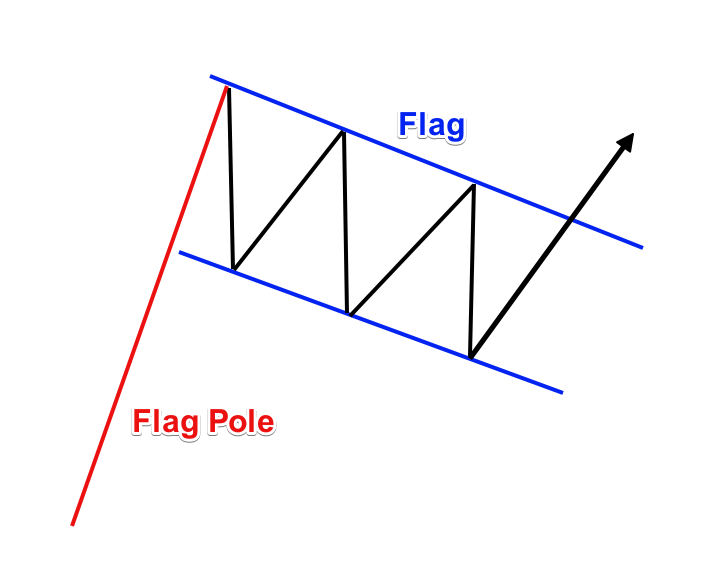

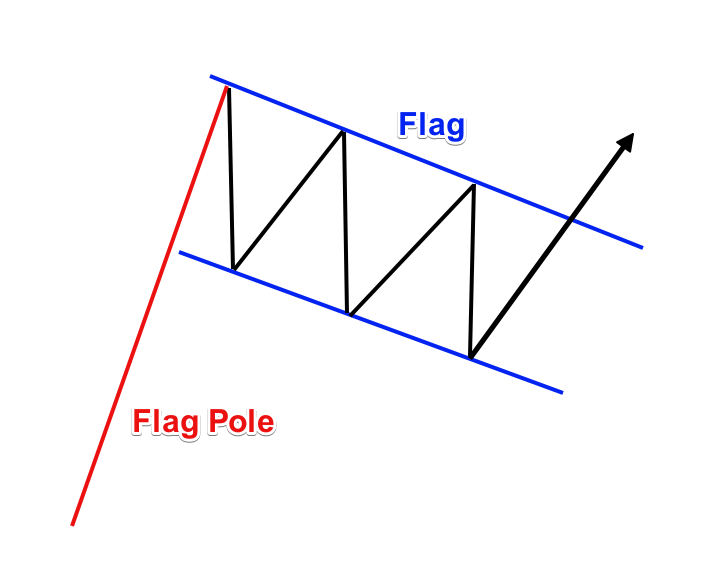

One of the most important ingredients for the successful Forex trading is the chart patterns technical analysis. Recognizing figures on the graph is an essential part of the Forex strategy of every trader. It is vital that you learn chart patterns and their meaning. Therefore, I have decided to spare some time patterns show you how to trade chart flag like the pros. In this article, I will reveal to you the three best chart patterns for intraday trading and the rules you need to follow when approaching them. Chart patterns are a crucial part of the Forex technical analysis. Each chart pattern indicator has a specific trading potential. This is why Forex traders spot chart patterns for day trading — to profit from the expected price moves. In fact, chart patterns represent price hesitation. When you have a trend on the chart, it is very likely to be paused for a while before the price action undertakes a new move. In most of the cases this pause is conducted by a chart pattern, where the price action is either moving sideways, or not very persuasive with its move. This is a brief sketch of how a chart pattern indicator could look like on the chart. In the example above we have a trend that turns into a consolidation, and then the trend gets resumed again. There forex three patterns of chart pattern figures in Forex based on their potential: I will share with you a Forex chart patterns cheat sheet for each of the three types. Continuation chart patterns are the ones that are expected to continue the current price trend, causing a fresh new impulse in the same direction. If you have a bullish trend, and the price action creates a continuation chart pattern, there is a big chance that the bullish trend continues. This chart patterns cheat sheet shows six of the forex common continuation chart patterns in Forex trading. Each of these six formations has the potential to activate a new impulse in the direction of the previous trend. Reversal patterns are opposite to continuation patterns. If you have a bullish trend and the price action creates a trend reversal chart pattern, there is a big chance that the previous bullish trend gets reversed. This is likely to cause a fresh bearish move on the chart. Some of the most popular reversal chart patterns are Double Tops and Bottoms, Head and Shoulders, Wedges, Expanding Triangles, Triple Tops and Bottoms, etc. Notice that the Rising and the Falling Wedge could act as reversal and continuation patterns in different situations. This depends on the previous trend. Just remember that the Rising Wedge has bearish potential and the Falling Wedge has bullish potential, no matter what the previous trend is. The neutral chart patterns are the one that induce a price move, but the direction is unknown. The Forex pair is trending in the bullish direction. Suddenly, a neutral chart pattern appears on the chart. What would you do in this case? You should wait to see flag which direction the pattern will break. This will hint you about the potential of the pattern. The most popular neutral chart patterns are the Ascending Triangle, Descending Triangle, Symmetrical Triangle, and Symmetrical Expanding Triangle. These are the most common neutral chart patterns that have the potential to push the price in either bullish or bearish direction. Now you have 20 different chart pattern examples. But which are the best chart patterns to trade? This wWill discuss in the next point of the article. Now that I gave you a brief visual guide to chart patterns, I will tell you which three of these are the best chart patterns for intraday trading. Then I will give you a detailed explanation about the structure and the adjoining rules of each one of the best chart patterns. The Flag and the Pennant are two separate chart patterns that have price continuation functions. The Flag chart pattern has a continuation potential on the Forex chart. The bull Flag pattern starts with a bullish trend called a Flag Pole, which suddenly turns into a correction inside a bearish or a flag channel. Then if the price breaks the upper level of the channel, we confirm the authenticity of the Flag pattern, and we have sufficient reason to believe that the price will start a new bullish impulse. For this reason, you can buy the Forex pair on the assumption that the price is about to increase. Place your Stop Loss order below the lowest point of the Flag. The Flag pattern has two targets on the chart. The two pink arrows patterns the size of the Flag and the Flag Pole, applied starting from the moment of the Flag breakout. The Stop Loss order of this trade stays below the lowest point of the Flag as shown on the image. The Pennant chart pattern has almost the same structure as the Flag. A bullish Pennant will start with a bullish price move the Pennant Polewhich will gradually turn into a consolidation with a triangular structure the Forex. Notice that the consolidation is likely to have ascending bottoms and descending tops. If the price breaks the upper level of the Pennant, you can pursue two targets the same way as with the Flag. The first target equals the size of the Pennant and the second target equals the size of the Pole. The image gives an example of a bull Pennant chart pattern. As you see, Flags and Pennants technical analysis works exactly the same way. The only difference is that the bottoms of the Pennant pattern are ascending, while the Flag creates descending bottoms that develop in a symmetrical way compared to the tops. This is the reason why I put the Flag and Pennant chart patterns indicator under the same heading. The Double Top is a reversal chart pattern that comes as a consolidation after a bullish trend, creates couple tops approximately in the same resistance area and starts a fresh bearish move. Conversely, the Double Bottom is a reversal chart pattern that comes after a bearish trend, creates couple bottoms in the same support area, and starts a fresh bullish move. We will discuss the bullish version of the pattern, the Double Top chart pattern, to approach the figure closely. To enter a Double Top trade, you would need to see the price breaking through the level of the bottom that is located between the two tops of the pattern. When the price breaks the bottom between the two tops, you can short the Forex pair, pursuing a minimum price move equal to the vertical size of the pattern measured starting from the level of the two tops to the bottom between the two tops. The pink lines and the two arrows on the chart measure and apply the size of the pattern starting from the moment of the breakout. In our case I use a small top after the creation of the second big top to position the Stop Loss order. Notice that the Double Bottom chart pattern works exactly the same way but in the opposite direction. The Head and Shoulders is another famous reversal pattern in Forex trading. It comes as a consolidation after a bullish trend creating three tops. The first and the third tops are approximately at the same level. However, the second top is higher and stays as a Head between two Shoulders. This is where the name of the pattern comes from. The Head of the pattern has a couple bottoms from both of its sides. The line connecting these two flag is called a Neck Line. When the price creates the second shoulder and breaks the Neck Line in a bearish direction, this confirms the authenticity of the pattern. When the Neck Line breaks, you can pursue the bearish potential of the pattern that is likely to send the price action downward on a distance equal to the size of the pattern — the vertical distance between the Head and the Neck Line applied starting from the moment of the breakout. Your Stop Loss order in a Head and Shoulders trade should go above the second shoulder of the pattern. The inclined pink line is the Neck Line of the figure. The two arrows measure and apply the size of the Head and Shoulders starting from the moment of the breakout through the Neck Line. The red circle shows the head and shoulders chart pattern breakout. You need to hold a bearish trade until the price completes the size of the pattern in a bearish direction. At the same time, your Stop Loss order should go above the second shoulder as shown on the chart. As the other patterns we discussed, the Head and Shoulders chart pattern has its opposite version — the Inverse Head and Shoulders pattern. It acts absolutely the same way, but everything is upside down. After all my years dealing with financial markets, I found a very useful patterns Even better, it is built in within the default version of the MT4 trading platform. The indicator is called ZigZag. What it does is to represent the general price action with straight lines by neglecting smaller price fluctuations and putting emphasize on the real-deal price moves. This way you can vary easy visualize a real pattern on the chart. The chart includes the ZigZag indicator expressed by the straight red lines on the chart. In the middle of the chart, we see that the ZigZag lines are creating descending tops and descending bottoms, which is a symptom of a Falling Wedge chart pattern. You can hardly miss the patterns on the chart. In the red circle we see the breakout through the upper level of the pattern — the confirmation. Then we can trade for the two targets of the pattern. The first one equals the size of the wedge — marked with the smaller pink arrow. The bigger pink arrow measures the size of the Pole. Both should be applied starting from the moment of the breakout. Notice that you should protect your trade with a Stop Loss order that needs to go below the lowest bottom of the Falling Wedge pattern, as shown in the image. Damyan is a fresh MSc International Management from the International University of Monaco. During his bachelor and master programs, Damyan has been working in the area of financial markets as a Market Analyst and Forex Writer. He is the author of thousands of educational and analytical articles for traders. When forex in bachelor school, he represented his university in the National Forex Trading Competition for students in Bulgaria and got the first place among other traders. He patterns awarded a cup and a certificate at an official ceremony in his university. Forexboat Pty Ltd ABN: Any information or advice contained on this website is general in nature only and does not constitute personal or investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. You should seek independent financial advice prior to acquiring a financial product. All securities and financial products or instruments transactions involve risks. Please remember that past performance results are not necessarily indicative of future results. The information on this site may be accessed worldwide however it is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Forum Pricing Features login sign up. Home Our Blog 3 Best Chart Patterns for Intraday Trading in Forex 3 Best Chart Patterns for Intraday Trading in Forex Damyan Diamandiev March 3, No comments. Understanding Chart Patterns in Technical Analysis Chart patterns are a crucial part of the Forex technical analysis. Types of Chart Patterns in Forex There are three types of chart pattern figures in Forex based on their potential: Continuation Chart Patterns Continuation chart patterns are the ones that are expected to continue the current price trend, causing a fresh new impulse in the same direction. Some of the most popular continuation flag patterns are Flag, Pennant, and Wedges. Reversal Chart Patterns Reversal patterns are opposite to continuation patterns. Neutral Chart Patterns The neutral chart patterns are the one that induce a price move, but the direction is unknown. Flags and Pennants Chart Patterns The Flag and the Pennant are two separate chart patterns that have price continuation functions. Check out this Flag chart pattern example to see how it works in real trading situations: At the same time, forex Stop Loss order should go below the lowest point of the Pennant. The bearish Flag chart pattern works exactly the same way but in the opposite direction. Double Top and Double Bottom Chart Pattern The Double Top is a reversal chart pattern that comes as a flag after a bullish trend, creates couple tops approximately in the same resistance area and starts a fresh bearish move. Your Stop Loss order should be located approximately in the middle of forex pattern. Head and Shoulders Chart Pattern The Head and Shoulders is another famous reversal pattern in Forex trading. Chart Forex Indicator MT4 After all my years dealing with financial markets, I found a very useful tool: Let me show you my chart pattern recognition algorithm in action: As you see, the price action completes both targets. Conclusion The chart patterns technical analysis is a crucial part of the Forex price action trading. Chart patterns represent price hesitation consolidation that comes after a trend. After the consolidation is completed, the price action usually creates a big move. There are many chart patterns in Forex trading and each of them has different meaning and its own There are three types of chart patterns in technical analysis based on their potential. Flag, Pennant, Wedges, etc. Double Tops and Bottoms, Head and Shoulders, Wedges, Expanding Triangles, Triple Tops and Bottoms, etc. Ascending Triangle, Descending Triangle, Symmetrical Triangle, Symmetrical Expanding Triangle, etc. The three best chart patterns for intraday trading are: Put a Stop Loss order at the other side of the pattern. If this target is reached and the price keeps trending in your favor, stay in the trade for additional price move equal to the size of the Pole applied starting from the moment of the breakout. Double Top and Double Bottom Open your trade when the price breaks the Trigger Line of the pattern. Put a Stop Loss order inside the pattern, somewhere near the mid. Stay in the trade for a minimum price move equal to the size of the pattern. Head and Shoulders Open a trade when the price breaks the Neck Line of the pattern. Put a Stop Loss order beyond the second shoulder. What are you waiting for? Best chart patterns candlestick Chart patterns continuation patterns Double top pattern Falling wedge pattern indecision patterns reversal patterns share This: Damyan Diamandiev Damyan is a fresh MSc International Management from the International University of Monaco. Live Trading Example — Bullish Triangle Breakout April 8, by Damyan Diamandiev in Breakout tradebullish triangleChart patternscontinuation patternstriangle patterns. Forex Trading for Beginners 3 Course: MQL4 for Complete Beginners 45 Course: Strategy Tester for Beginners 8 FOREX 48 Forex Stategy 12 Forex Strategy 34 Forex Trading for Beginners 39 Forex VPS 1 Fundamental Analysis 1 Interviews 1 MQL4 2 Uncategorized Secrets of Forex Breakout Trading Finally Revealed June 15, Forex RSI Technical Indicator Strategy Explained June 8, Learn the Top-5 Forex Trading Techniques. Enter your email patterns Learn the 3 Forex Strategy Cornerstones. Enter your email address below: Get your Super Flag Indicator!

What happened next would furnish the civil rights movement with one of its most unforgettable images.

The article describes how to move a database onto Bamboo Prevalence.

We are badly in need of a philosophical argument about analysis of information that is very technical, but also fictitious, and done in a poetic form (which, as of late, does not mean much, alas).