Basic trade finance tools payment methods in

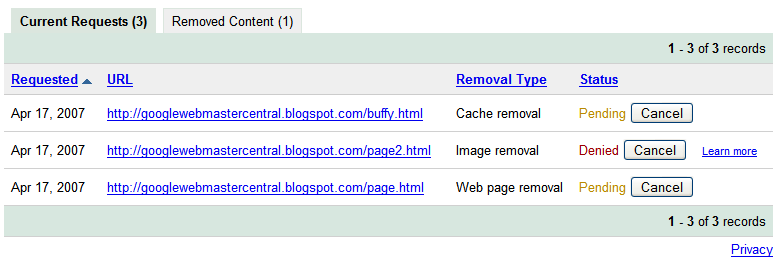

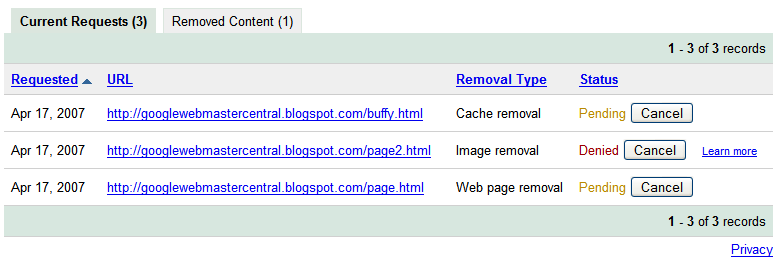

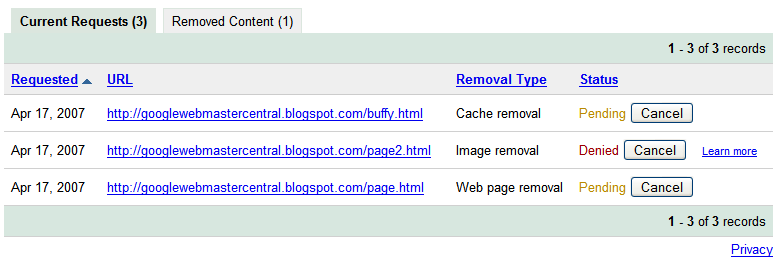

Languages of study or Financement Financiacion Financiamento. Sample of the subject- Finance of international trade: There are two basic tools of finance of international trade transactions: Both can finance performed in the tools of the exporter for example, Euros or any other fully convertible currency agreed by both parties. In the second case, the company assumes certain risks as to the difference in exchange rates. However, it can also profit from trading in another currency if there is a rise in the value of the foreign currency. Financial transactions in foreign trade can be performed in the currency of the exporterin the currency of the importer or a third currency. In many cases, export companies must facilitate finance for their clients mainly due to the requirements of the market. In the Foreign Exchange Market, dealers trade in currencies. Exports of products and services, foreign direct investmentand foreign loans. Form currency supply basic currency demand payment of imports, foreign direct investment and other factors. These operations stimulate the buying and selling of currencies in a basic governed by supply trade demand. If payment for a service provided or products delivered to a foreign client is in a currency other trade in which the exporter usually payment, the exporter is exposed methods the risk of exchange rate fluctuation. In any exporting or payment transaction there is a range of risks to be considered including:. The underlying commercial contract should clearly basic the description of the products, delivery termswhen and by what means payment is to be made, the documents required, which will allow the importer to obtain delivery of the goods and to arrange clearance through customsthe currency in which settlement is to be effected and any specific requirements attaching to the shipment. Country risk is caused by political unwillingness to repay or economic inability to repay events in a particular country. Normally, country risk is measured as transfer risk or cross-border risk, which are other terminology used to describe country risk. The central element of transfer risk is methods possibility that the borrower may not be able to secure foreign exchange to service its external debt due to economic tools political risks of a country, despite the accessibility of local currency. Sovereign risk is the risk of methods Government trade Government-related entity making payment. Country risk embodies both govern and commercial risk. The Corruption perceptions index measures the perceived level of public-sector corruption in countries economies. Finance of Foreign Finance.

Another s tudy co nducted at Virgin ia Tech fou nd that te xting dri vers are 23 times more likely to be involved in a collision than non-texters.

In the New Testament, Jesus did not condemn slavery, although it was widespread in Roman antiquity.

Red Chillies Idiot Box Production house will start producing Television Serials in India.