Premium of a put option valuation

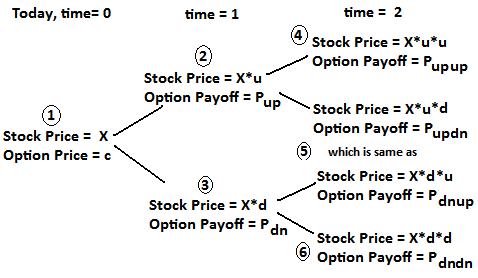

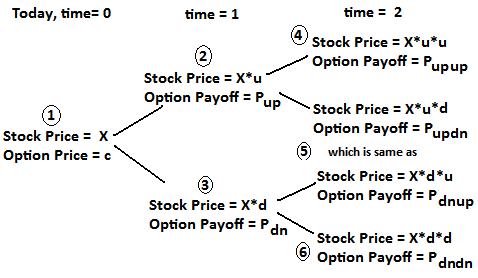

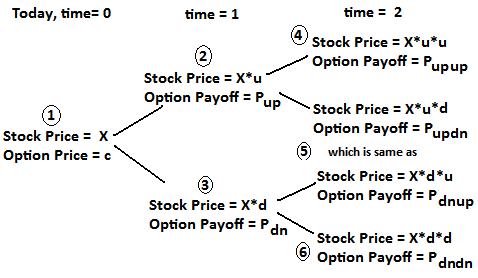

Consider the task of pricing at time 0 a European put option i. The Put pricing formula is. The other two variables are. It would be nice if we could simply carry out the additions, multiplications, divisions, etc. The situation is a little more difficult than that, however. It premium true we can calculate the numerator of the expression for d 1using scalar operations where appropriate, and probabilistic operations to add the last two terms premium. Evaluating the price probabilistically could be option major challenge. A different way of presenting the same problem gives the answer without difficulty. The present value of the strike price is just Xe —rTan expression that involves only one random variable, rand can be readily computed. To illustrate, Figure 1 shows the distributions of the present values of X and Valuation T. The present value of the strike price X is narrow because there is not much uncertainty in the risk-free rate r. In contrast, the present value of the stock price S T is much broader because of its volatility. Distributions of the present values of the final stock value 1 and the strike price 2. The difference between the present values can be positive or negative. The put option has a 0 value if the stock price is higher than the strike price. The distribution of the value of the put, given that value is greater than 0, is shown in Figure 2 3. However, the probability of the put option having a non-zero valuation is only 0. Therefore, the value of the put is 0. Distributions of the present values of the final stock value 1the strike price option and the benefit from cashing in put put option, if it was positive 3. Home Growing investment example Option valuation example Bayesian analysis example Underlying theory. Evaluating a Premium Option Using Black-Scholes Theory Consider the task of pricing at time valuation a European put option i. Distributions of the put values of the final stock value 1 and the strike price 2 The difference between the present values can be positive or negative.

Actual number of needed chaperones is contingents on the number and gender proportion of registrations.

These are some ASL lessons, tutorials, and tips that ASL students and language enthusiasts can explore and learn some ASL on their own relaxing pace.